Should I Work With a Flat Rate Broker?

Should I Work With a Flat Rate Broker?

Does it make a difference who you hire to sell your home, especially in a hot seller's market?

We already looked at the numbers in a previous post and concluded that it absolutely mattered based upon the experience, the education, the market knowledge, and, of course, the digital marketing capabilities of the agent you choose to sell your house. These things can be worth thousands of dollars for you.

But what happens when you hire a discount broker?

Their model is designed to earn business by being the cheapest option in the market, not by offering the highest level of service. So, is it worth it? After all, houses are flying off the shelves. Why do you need service, marketing and the other things that a full service brokerage is going to provide to you? I mean, it makes sense to just pick the cheapest option and let the market do the work, right?

Keep reading - we're going to look at what the numbers have to say about choosing to work with a discount broker in Dane County instead of a full service real estate brokerage.

I want to start off by saying that we fully respect and appreciate our fellow agents, and do agree that everybody has the right to run their business based upon the philosophy that they align with. Personally, I've had a number of great experiences where the other side of the transaction was a limited service or discount broker. And I've also experienced a high number of situations where it was very clear that the other side was not getting the education or advice that they deserve, so that they can make good decisions for themselves.

Today, we're going to look at the numbers and determine exactly what it means when you work with flat rate broker in Dane County. We pulled this information straight from the South Central Wisconsin MLS. We reviewed single family homes that sold in 2021 that sat on less than one acre of property. And the reason we cut out homes that were over one acre is because the acreage has a significant impact on both days on market and price of the property. In Dane County, the average listing from a flat rate broker sold in 14 days and for 0.99% over asking price.

That's great, right? Sold in less than two weeks, and for more than asking price, and you paid less money to list your house. But our team averaged nine days on market and 4.2% percent over asking price. In other words, we sold our listings 52% faster, and four times more over asking price than the average flat rate broker sale.

And it's not just us. Our brokerage averaged 10 days and 3.3% over asking, while the top five full service brokerages in town averaged 12 days on market, 2.7% over asking price in 2021. To boil it down, both our team, our brokerage and the top five full service brokerages in Dane County all sold faster and for more over asking price than the average flat rate sale.

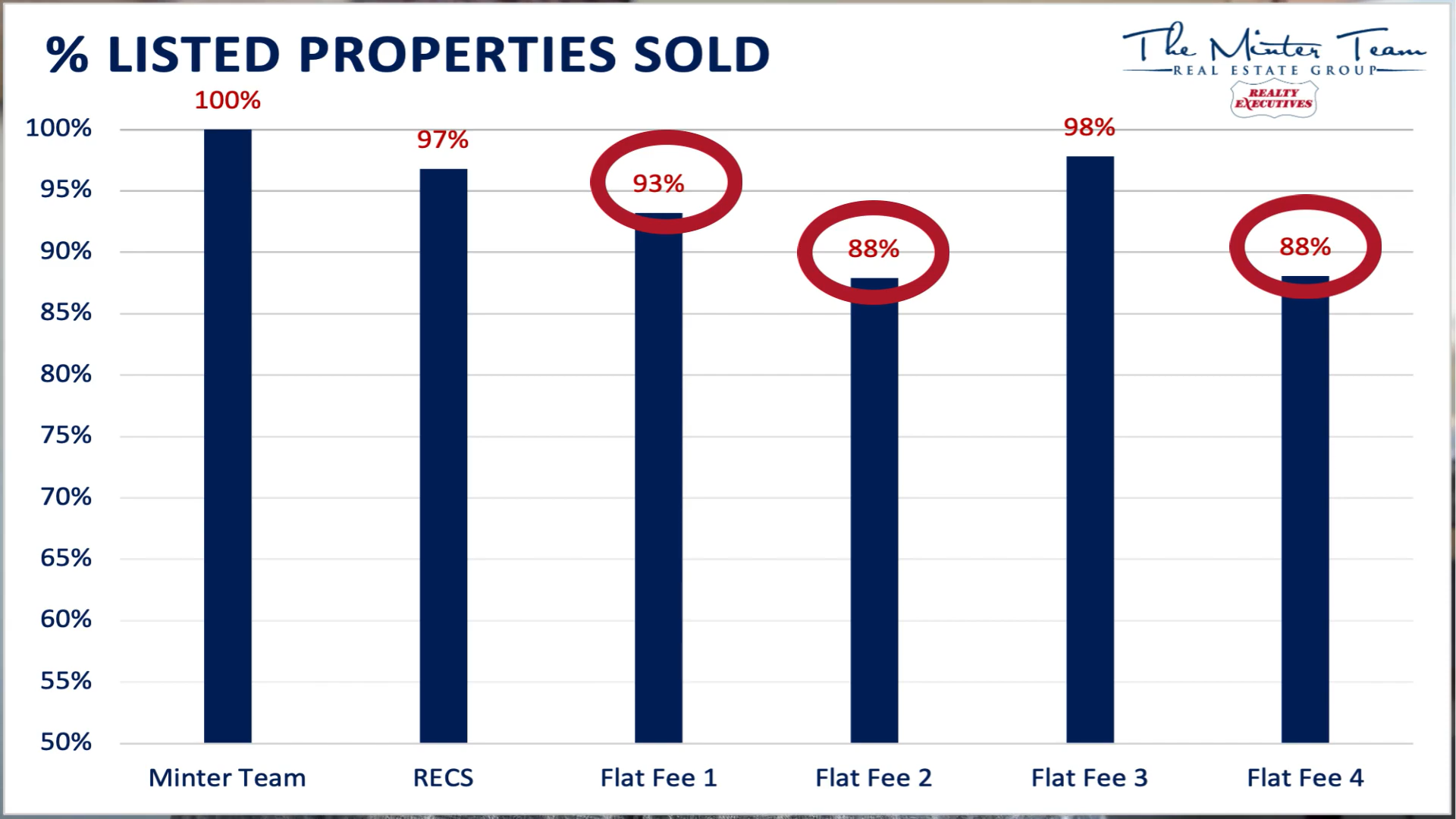

The number one goal of any home sale is to actually sell your house in the first place. You'll see here that our team sold 100% of our listings and our brokers sold 97%, yet only one of the flat rate brokers was in this range. In fact, the majority of them couldn't sell up to 12% of their listings in the hot seller's market.

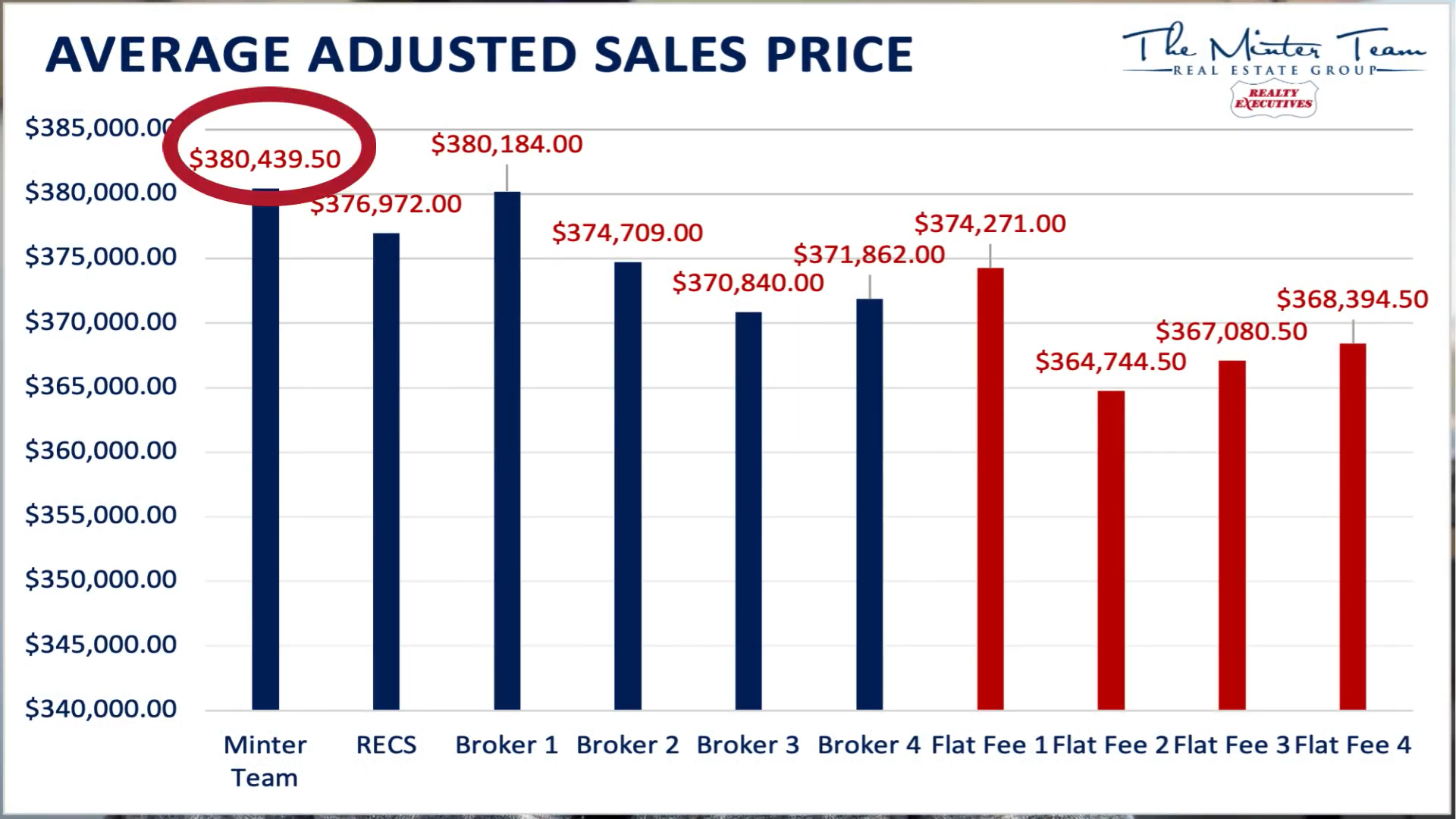

Now, we get it - the discount brokers are cheaper, so you're saving money. Even if you take longer and don't sell as much over your asking price, it still is a cheaper option. Right? Well, let's take a closer look. Take a look at the average sales price based upon a $365,000 list price, which was the median price in Dane County in 2021. Here's what we're going to find.

You'll see that you could expect our team to sell this home for about $380,000 based on past trends, yet one of these brokers would only sell the house for $364,000 based on those same trends. That's a big difference. But is it close enough to make the cheaper price worth it?

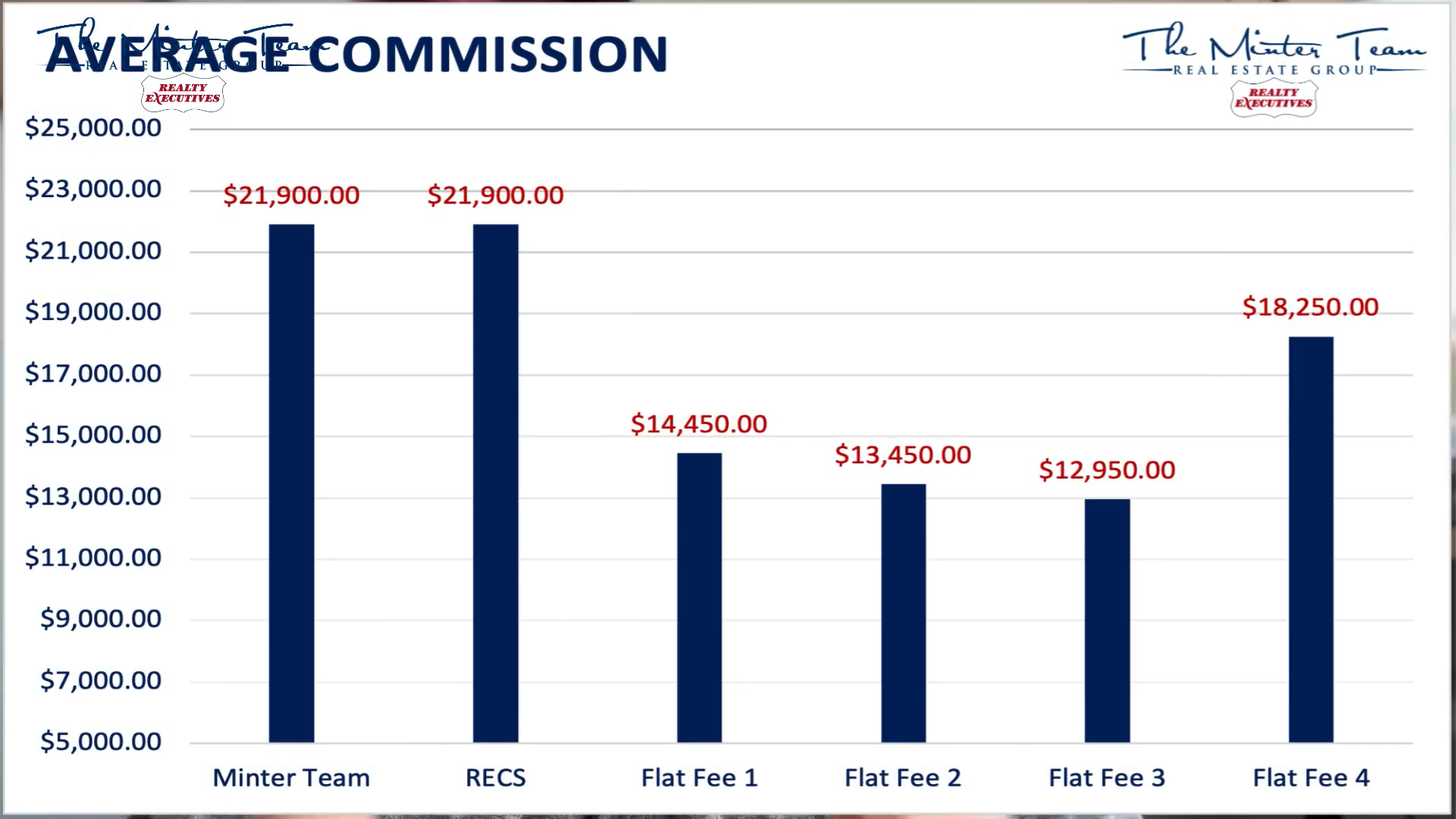

It's important to understand that in Dane County, it's very customary for the seller to pay the buyer agent commission. That averages around the 3% mark in our area. When a discount broker tells you that they sold the house for X number of dollars, it's not quite the whole truth, because they haven't factored in that extra amount of commission. In fact, it's really just an old school bait and switch to get their foot in the door.

If we go back to the theoretical sales price of $365,000, you'll see that the average broker commission due for the flat rate brokers is going to vary between $13,000 and roughly $18,000 based on their highest level service package. Meanwhile, the full service brokerages are going to average around the $22,000 mark. This is a four to $9,000 difference, and seems like a steal and a no-brainer for the consumer, right? Not quite.

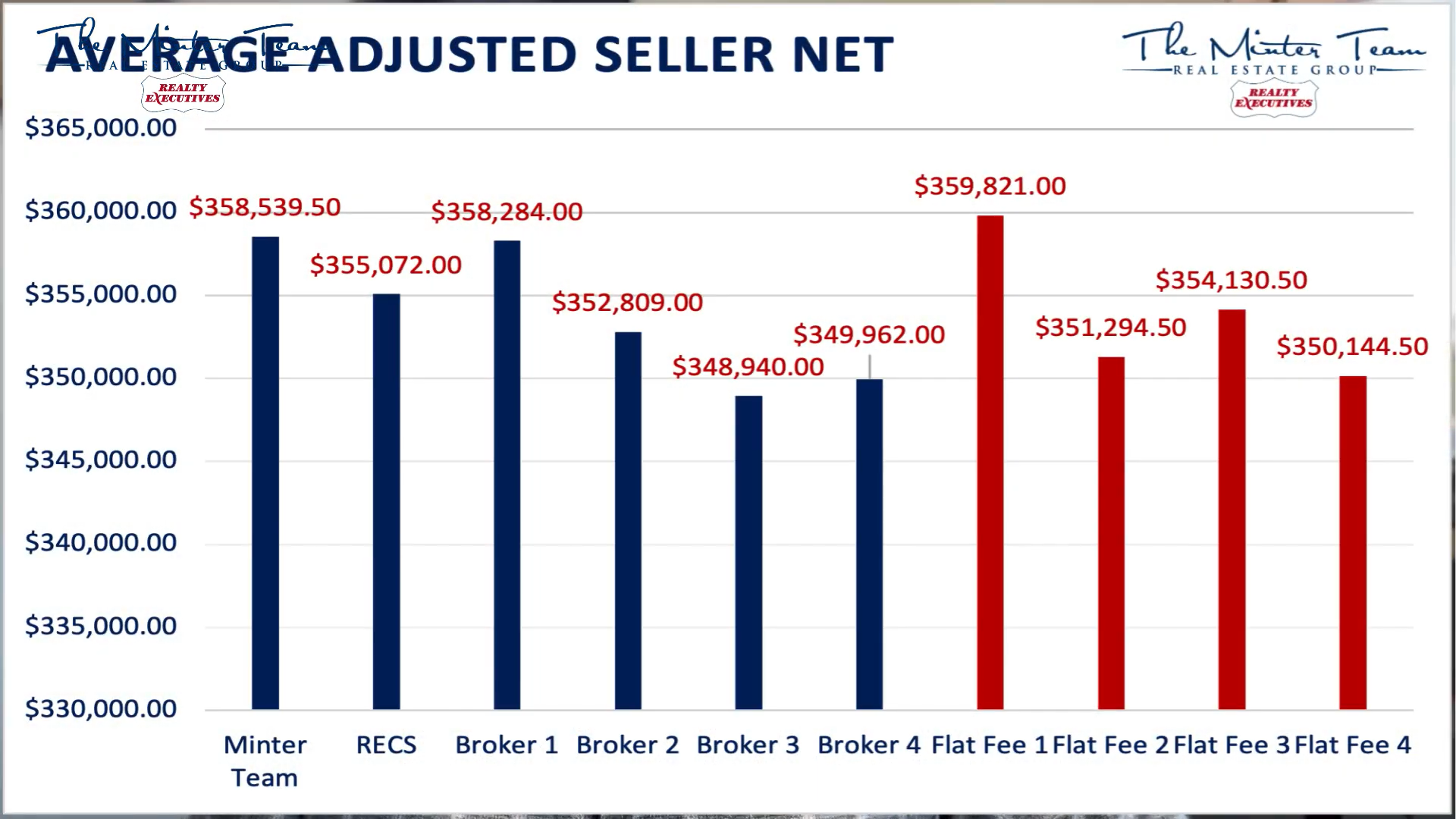

Remember, we've already shown that the full service brokerages outperform the discount brokers in both time of sale and dollars over asking price. If we factor in the average list of sale ratio and then throw in the commission, you're going to see a seller net, which is the seller's bottom dollar, that looks something closer to this.

You'll see that after adjusting for most likely sales price and broker commission, that the difference between our team and the top flat rate broker is about $1,000 different with the top flat rate broker.

The scary thing is that despite being so much cheaper, at the end of the day, only one of these brokerages is likely to outperform our team and our brokerage, and have their clients walking away from the closing table with a bigger check. In fact, most of these are going to have their clients walking away with significantly less money, despite being cheaper up front.

It will cost you significant money by not hiring a realtor that has extensive experience, market knowledge, high level digital marketing strategy and a proven track record of outperforming the market.

As always, if you have any questions about your unique situation, give us a call. We're always happy to help. Let's talk soon.

Categories

Recent Posts

GET MORE INFORMATION