National Housing Market Update - May 2022

National Housing Market Update - May 2022

Rising interest rates, inflation concerns and supply-demand issues have people talking crash, bubble and recession, but is it time to be concerned? Spoiler alert, the answer is no. So let's take a look at why this market might not be as scary as the media is telling you, in this month's national market update.

I got into this business just as we were coming out of the last market crash, and I can tell you that over the last decade, we've seen a ton of changing market conditions, but nothing that exists today should have us concerned about the word "crash". In fact, some of the factors that are in play and have people talking about that right now have already occurred over the last 10 years and both buyers and sellers in those markets have done just fine.

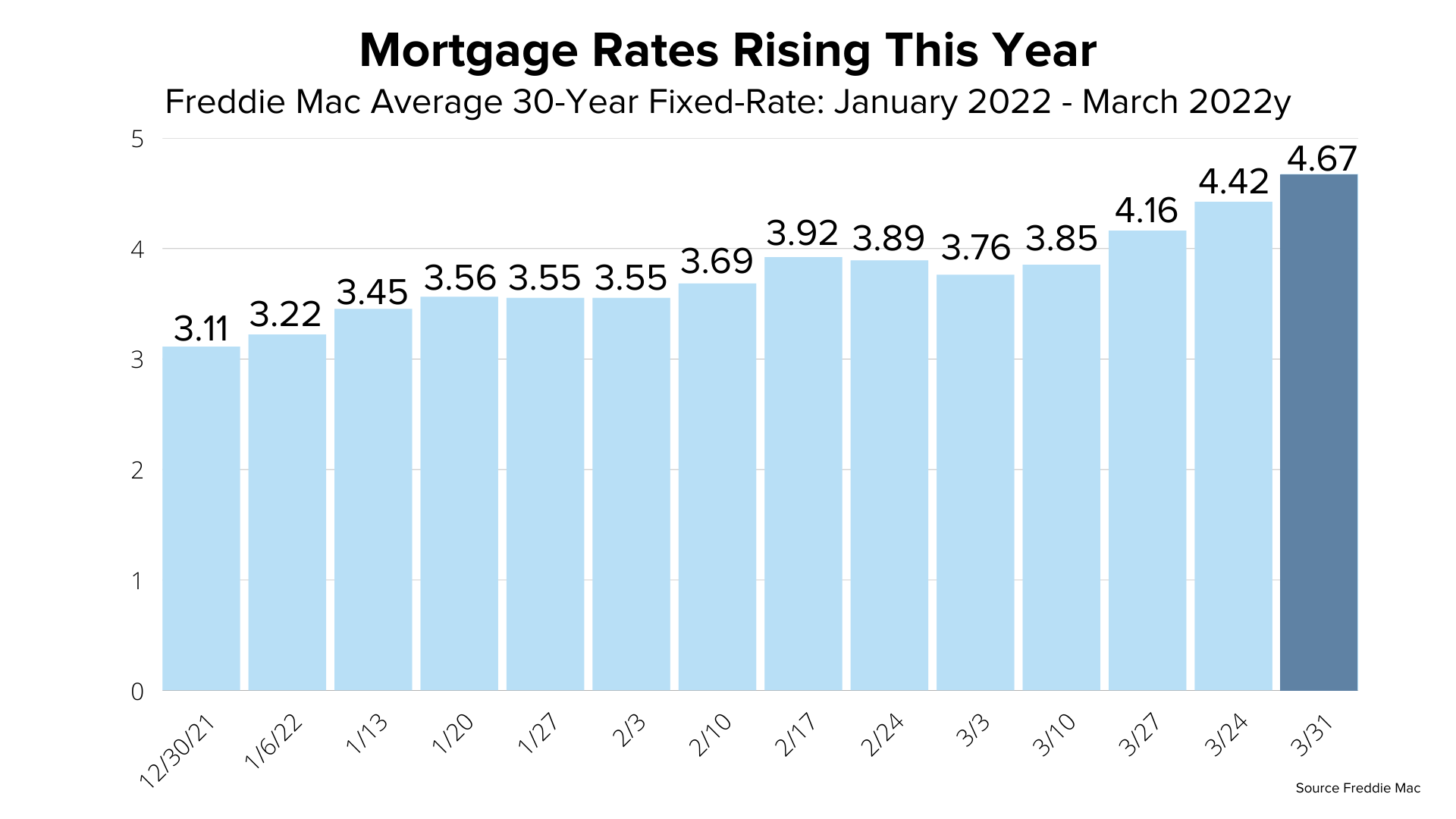

For starters, interest rates have been a huge topic of conversation this year and rightfully so. According to Freddie Mac, we started this year with interest rates on a 30-year fix at around 3.1%. We jumped up to 4.7% through March and during the course of April locally, we've certainly seen rates hit 5.25% or more.

Right now, many experts are actually predicting that rates could jump as high as 6 or 6.5% over the course of the summer, depending on how the market reacts to inflation numbers. Considering a 1% rise in interest rates is roughly a 10% reduction in purchase power, this can be a huge factor for how our market is going to perform for the rest of the year.

Let's look at a sample scenario. If we had a home buyer that was ready to buy a $400,000.00 home and they started their process in the winter when interest rates were about 3.25% give or take, that house with 20% down in January would have cost them about $1,390.00 a month in principle and interest. Yet if rates hit 6.25%, that same exact $400,000.00 house is going to cost them almost $1,970.00 a month at principal and interest. That is a roughly $600.00 price increase on their monthly payment only for interest. They're not getting any more house or any extra benefits of it.

Now let's reverse that and take a look at it the other way. If somebody was pre-approved for a debt of $1,390.00 a month to get to that $400,000.00 purchase price, if rates get up to 6.25%, that $1,390.00 a month is only going to buy you $280,000.00. From January into the summer, that could cost this theoretical buyer $120,000.00 in purchase power. That's huge, and the impact that we're going to see is that there's going to be a number of home buyers that are simply going to get priced out of the market because rising interest rates are not allowing them to purchase the house that would make it either worth it for them to move or purchase in the first place.

In other words, we can start to see buyer demand shrink as some buyers will simply be priced out of the market, and quite frankly, that's probably healthy for the current state of the market. But we can't expect the bottom to fall out. We've had 4+% interest rates, 5% interest rates over the last decade, and people still bought and sold houses. There was still good market dynamics for a lot of people, and I expect to see much of the same around here, even if rates continue to rise.

Let's take a quick look back in time to see how rising rates have affected home prices. We can look at previous years where rates jumped quickly over 1% and we generally see a common thread. See, prices will still go up, but sales will drop as a result of buyers getting priced out of the market.

We see this here in Dane County, it could actually be a good thing. Our market has been severely stressed with low supply and this could create some more balance. So if rates are going to take some home buyers out of the market and prices are going to continue to rise, is that setting up the stage for a bubble bursting or a crash? Not exactly. No data out there really supports the idea of a crash in this market. In fact, Altos Research says, "We keep watching for it, but there's absolutely no signs of market slowdown anywhere in the data. If anything we're seeing the market continue to heat up."

Inflation has also been a big topic this year, but when it comes to housing, home ownership can really be a hedge or safety net against the effects of inflation. In most decades, home price appreciation has outperformed inflation. So in other words, your home is more likely to appreciate faster than inflation, leading to increased wealth. When you own a home, your monthly mortgage payment typically stays stable and predictable, despite how the economy is performing.

Rising rates, higher prices, inflation, is it a bad time to buy a home? Well this is kind of a loaded question. Generally speaking, I believe that you shouldn't buy a home just because the market says you should buy a home. You should buy a home because your lifestyle dictates it. Maybe you're settled in a location and you're not going to be moving out of the area or your family dynamics changed either in growth or with people moving out and it's time to downsize. Maybe you have too much space or not enough space. Maybe you need more space. Maybe you need a yard for your dog or to garden in. Whatever your lifestyle dictates, if that's the best move for you, then there's no point in waiting for a better market to come around.

Rates are not expected to drop into the threes anytime soon. Prices are not going to decrease anytime soon. So, every month that you wait to buy a home is costing you more money out of your monthly budget.

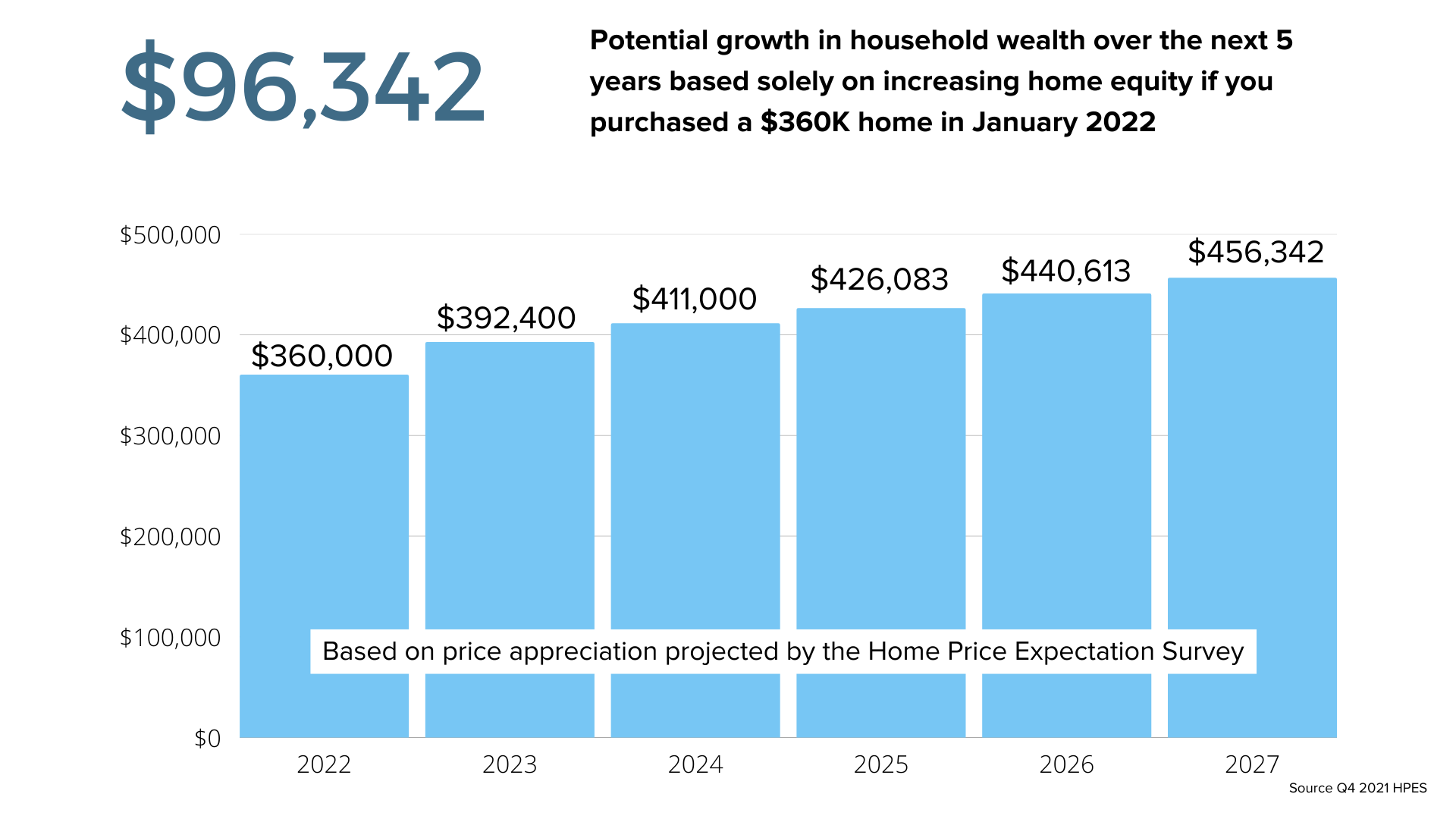

For a longer range visual, we can take a look at this graph, showing projected appreciation over the next five years on a home purchased today at $360,000.00.

This buyer is expected to have almost $100,000.00 in equity from this investment by 2027. Meanwhile, if they're waiting in a rental for the market to shift, that equity would be non-existent.

If you have any questions or comments about anything I shared in this post, leave us a comment; I'd love to hear from you and know what you're thinking. And as always, if you have any questions about your unique situation and how today's market dynamics could affect your goals, reach out to my team, I promise we will take great care of you along the way. Let's connect soon.

Categories

Recent Posts

GET MORE INFORMATION